Goldman Sachs Group Inc. (

GS) broke above the 20-day price channel on Monday and confirmed the bull signal on Tuesday, but with go-nowhere day that removed much of the momentum from the chart.

The signal was part of a rise that began on July 3 from $149.28 and continued straight through the July 16 earnings announcement, which prompted a two-day decline that remained above the low set four days prior. The price then resumed its upward course, hitting a swing high today of $167.41, a level below the near-term high of $168.20 set on June 10.

Bigger picture, GS is in a weekly chart uptrend that began in July 2012 from $91.15. This is the fourth bull signal of the uptrend.

Two of three completed signals were profitable, averaging 10.1% over 36 days, compared to a 4.4% loss over six days for the unprofitable trade. The resulting 5.7% win/lose yield spread is sufficient to meet my preferences.

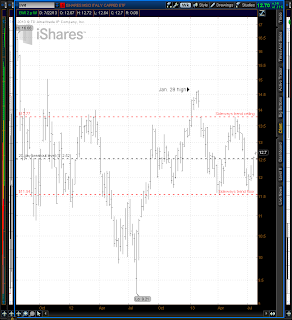

|

| GS 90 days 2-hour bars |

The fact that GS has yet to break through its June 10 swing high is troubling. If the current rise is a leg up that continues the uptrend, then the $168.20 level should be broken in short order. If it is in fact a steep upward correction within a downtrend, then $168.20 will not be seen again.

The Elliott wave count suggests the more bullish interpretation. If GS were indeed in a downtrend, then I would expect the first leg down (the zig) from $168.20 to be five waves down, not three as a chart shows, and the ensuing move up (the zag) to count as a correction pattern, perhaps an A-B-C.

My count shows the opposite -- A-B-C on the zig and 1-2-3-4-5 on the zag -- and so I'm inclined to think that at this level there is still some life left in the GS uptrend. I must add some caution that assessment. Wave counts on individual stocks can be fickle, and the ambiguities of Elliott wave counting can lead to wildly differing results, and to dramatic changes in the count as it progresses. That's a long way of saying, Maybe I'm right, and maybe I'm wrong.

The way to find out which conclusion is correct, the bullish or the bearish, is of course to use the 55-day price channel boundary to trigger a bull signal. That channel boundary -- no coincidence -- lies at $168.20, a mere 1% above Tuesday's closing price.

In other words, there is little penalty for waiting and much risk for jumping in prematurely.

GS was among three symbols to survive my initial screening, all having broken out to the upside.

I rejected

GDX because it had no upside breakouts during the present downtrend, which began in September 2012. To get some numbers I had to push the trend back to a turning point a year earlier, in September 2011, and the odds of a winning trade were only 1:3.

GXKEY has a win/lose yield spread of 1.9%, not to mention serious liquidity problems, with average volume running at only 3,000 shares a day.

Goldman Sachs, headquartered in New York, is a household name in finance, arguably the most influential financial company in the United States, if not the world. It alumni practically define the revolving door between the private sector and government.

Clout, however, doesn't always translate into expectations of success, especially for a company operating in a sector that is still trying to get its bearings after the shock of the housing collapse and ensuing recession. Analysts give Goldman a negative 65% enthusiasm rating.

Return on equity is respectable, at 12%. Long-term debt is running at more than double equity, far above the levels I like to see in my trades. However, high debt isn't unusual in banking and finance.

Goldman has had one losing quarter in the past dozen, back in 2011. The profitable quarters have been all over the map, but the last three have equaled or exceeded the quarters that came before during the period under analysis.

Institutions own 63% of shares. The stock has been bid up to a premium above the business Goldman is doing. It takes $1.75 in shares to control a dollar in sales.

GS on average trades 3.4 million shares a day, sufficient to support a wide selection of option strike prices with open interest running to four figures. The bid/ask spread on front-month at-the-money calls is 2.6%.

Implied volatility has been dropping steadily since late June and has reached 21%, the lowest level of the past six months.

Options are pricing in confidence that 68.2% of trades will fall between $155.97 and $176.55 over the next month, for a potential gain or loss of 6.2%, and between $161.32 and $171.20 over the next week.

Options activity was slow on Tuesday and tilted toward the bear side, with puts running at 69% of five-day average volume. Calls were at 40% of average volume.

Goldman Sachs Group next publishes earnings on Oct. 18. The stock goes ex-dividend on Aug. 28 for a quarterly payout yielding 1.2% annualized at today's prices.

Decision for my account: I find the case for waiting to open a GS position to be compelling. The risk/reward ratio certainly argues against jumping in until there's a true breakout above the June high.

I'm adding GS to my watchlist and will look at it again if it breaks above $168.20.

References

My trading rules can be read

here. And the classic Turtle Trading rules on which my rules are based can be read

here.

At several points in my analysis I use the number 68.2%. This comes from statistics and refers to the one standard deviation boundaries, which are expected to contain 68.2% of whatever is being studied. Putting it another way, given an item (a trade or whatever), there is a 68.2% chance that it will appear within those boundaries.

Elliott wave analysis tracks patterns in price movements. StockCharts has a good

explainer. The principal practioner of Elliott wave analysis is Robert Prechter at

Elliott Wave International. His book,

Elliott Wave Principle, is a must-read for people interested in this form of analysis, as is his most recent publication,

Visual Guide to Elliott Wave Trading.

Disclaimer

Tim Bovee, Private Trader tracks the analysis and trades of a private trader for his own accounts. Nothing in this blog constitutes a recommendation to buy or sell stocks, options or any other financial instrument. The only purpose of this blog is to provide education and entertainment.

No trader is ever 100 percent successful in his or her trades. Trading in the stock and option markets is risky and uncertain. Each trader must make trading decision decisions for his or her own account, and take responsibility for the consequences.